Context

CAFR (Romanian Chamber of Financial Auditors), like many other organization, is undergoing a digital transformation. As a result, not only within the profession, but also within the profile associations, changes are unavoidable.

CAFR has accrued information and experience for over 11 years, using a static database management application with auditors’ reports until the time of implementation. CAFR hopes to provide the over 5,400 members with a comprehensive way to communicate and organize their relationship with the new integrated system.

The digitized functionalities within the integrated system, developed on the WEBCON BPS platform, are those related to the community management activities:

- Management of the CAFR relationship with the auditing members, individual or legal persons, full members or trainees;

- Establishment of payment obligations and information on their settlement;

- Management of compulsory or optional courses;

- Control of the inspection activities of the auditing members;

- Processes related to the Human Resources department of CAFR;

- Analytical and synthetic reports.

At present, the system is also linked to the official CAFR auditing members’ site, the e-Learning platform and the financial-accounting application.

“Our goal was to create integrated business processes that would help and even automate our members’ coordination efforts. Combining digital working practices with workers’ and chamber members’ professional judgment pledges to yield positive results as the most successful way to the future.” – Adrian Popescu, President of CAFR.

Challenges

- The need to quick response and flexibly to changes imposed by applicable legislation;

- Developing a new Financial Intranet based on a business modelling approach with integrated procedures and sub-processes;

- Increasing agility and lowering costs by giving the IT department true autonomy in the creation of change management processes;

- Connecting the members-only extranet with the new BPM Intranet platform.

Solution

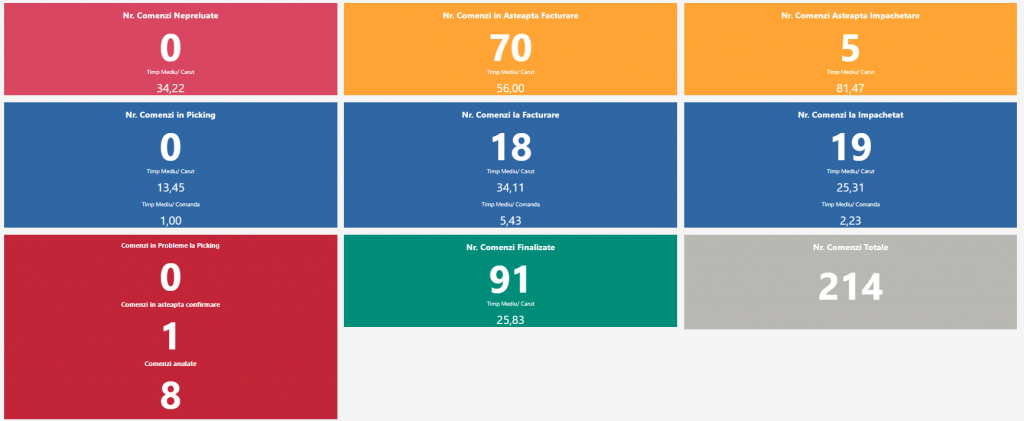

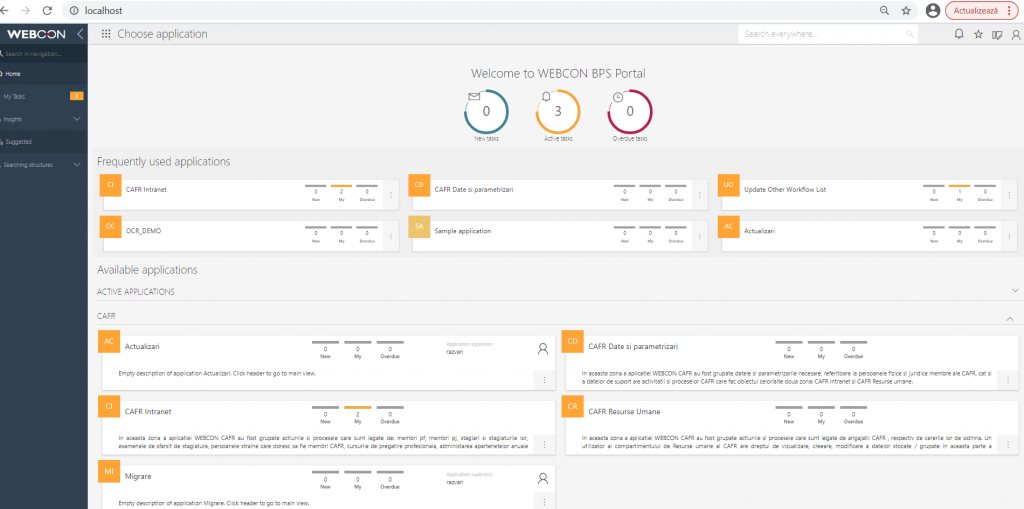

Developing an integrated system in the form of a primary dashboard that unifies many application modules. Each module is made up of procedures, actions, and reports that are organized by the types of tasks that a CAFR department must complete. The transition to the new application went smoothly, and users quickly adopted it.

Fig 1. General dashboard of the CAFR Intranet application

The system covers 5 areas that share inter-related stored data with each other: CAFR Data and Parameters, CAFR Intranet, CAFR Human Resources, CAFR Updates and CAFR Migration.

CAFR Data and Parameters includes:

- all dictionaries of data related to its members’ historical and current evidence-gathering activities;

- informational correlations between different areas of activities/processes, links to other application areas – visible among members – and the Chamber’s activities;

- definition of fees as generators of payment liabilities for each type of member, used in the calculation of fixed or variable fees, and have a direct link to the institution’s financial-accounting application.

Fig 2. Parameters dashboard

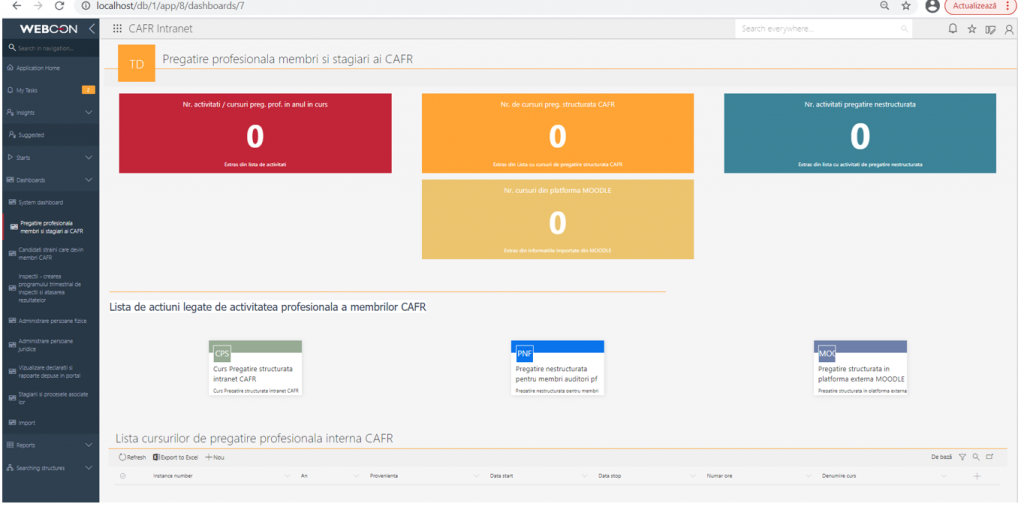

CAFR Intranet includes:

- a suite of parameterized dashboards that group relevant information and actions for each user.

Fig 3. CAFR Intranet module dashboard – professional preparation of members and trainees

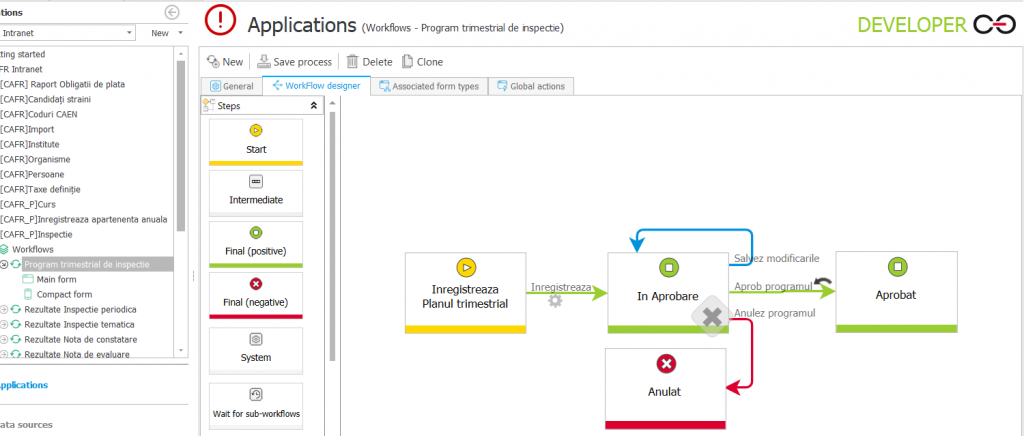

- the specific operations to each department, membership management workflows, payment obligations, inspections performed or reporting on the activity of members, including courses taken in the e-Learning platform.

Fig 4. Example of a simple process for modelling and advance paid by an auditor member

Fig 5. Example of a complex process for modelling

CAFR Human Resources includes:

- the vital support for the administration of the contacts of the employees of the institution as well as the process of registration of vacation requests.

Fig 6. CAFR Human Resources dashboard

ENCORSA has created a new type of portal for the extranet section, in which members may send activity reports or statements in order to produce a type of annual payment obligation. They are uploaded to the CAFR Intranet, where CAFR workers can view or edit them.

Results

Speed of implementation of legal requirements. Required feeds, fields, or reports can be updated in days or hours. Routine changes and the introduction of new workflows are done with CAFR’s internal resources.

Agility. Possibility of continuous adjustment of workflows in response to legislative changes specific to financial audit; Workflow changes can be sent to users in minutes. CAFR also has the ability to create custom reports.

Process traceability. Creating comprehensive digital feeds for controlling each compartment’s activity, correlating and displaying tailored information per auditing member, calculating the annual amount due, and using simple links to assist the user in analyzing a member’s activity from multiple perspectives. This tracing is combined with the ability to see a user’s change history.

Integration of existing systems. All the data necessary to monitor the activity of the members are brought and integrated in the Intranet: the courses carried out in the e-Learning platform, the information on the receipts made or the data on the reports submitted by the members in the External Portal.

Operational simplification. Unitary management through a single platform of the entire activity of the institution.

Automatic calculation of fixed or variable taxes. The activity and the changes made in the Intranet part are reflected in the balance of payment / collection obligations that are administered in the financial-accounting application.

Reports sent to the External Portal are automatically downloaded. Because the reports filed in the portal are taken over and processed immediately, and correlated with the other information in the system, real-time monitoring of the commitments arising from CAFR membership is possible.

About CAFR

The mission of the Romanian Chamber of Financial Auditors “CAFR” is to build on a solid foundation, the identity and public recognition of the profession of financial auditor in Romania. Its primary goal is to ensure the profession’s long-term growth and strengthening through the adoption of the Auditing Standards and the Code of Ethical and Professional Conduct, as well as the complete incorporation of the International Standards and the IFAC Code of Ethics. All of this enables financial auditors who are members of CAFR to deliver high-quality services to the general public and, in particular, the business community.

CAFR has over 5,400 individual members and 1,800 legal entities as direct members, as well as several hundred trainees who are educated and helped in their attempts to join the Chamber.

Concluding

The purpose of CAFR’s transformation is to take advantage of technology’s ability to carry out its work more easily, rapidly, reliably, and on a large scale at any moment.

This system helps to decrease the time spent managing and controlling tasks / procedures to a minimum, in addition to accountability, which is an important feature in any organization.

The project also yielded tangible results by reducing the time it took to realize, verify and report CAFR members’ activities, as well as eliminating human error.